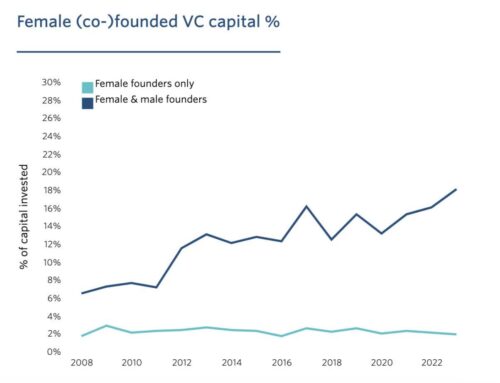

Last month, Inc42 Media published a report on Indian start-ups receiving more than $3.2bn in funding. Great news for the ecosystem, of course. But what was telling is that of the top 15 companies to have received these funds, not a single one has a woman founder. This is consistent with a recent report by the non-profit WinPE (Women in PE) that showed that the share of total funding that women founders received fell in 2023 to under 10%. Even in the US, where one expects venture capital (VC) to be more sophisticated, less than 2% of VC was invested in women-founded companies in 2022. Sadly, while the entrepreneurial spirit in women is strong, the unequal access to funding compared to their male counterparts is a reality that cannot be ignored.

Here are some sobering statistics – about the funding firms themselves. WinPE found that 70% of VC fund managers have senior leadership teams comprising entirely of men. The ratio of women across the industry workforce remains at around 20%, having seen a small dip in the pandemic years. Only ~2.5% of the fund's founding partners are women. The funding gap for women entrepreneurs is not just an Indian problem—it’s a global issue. According to Harvard Business Review, only 12% of decision-makers at venture capital firms are women, which perpetuates a lack of diversity in funding.

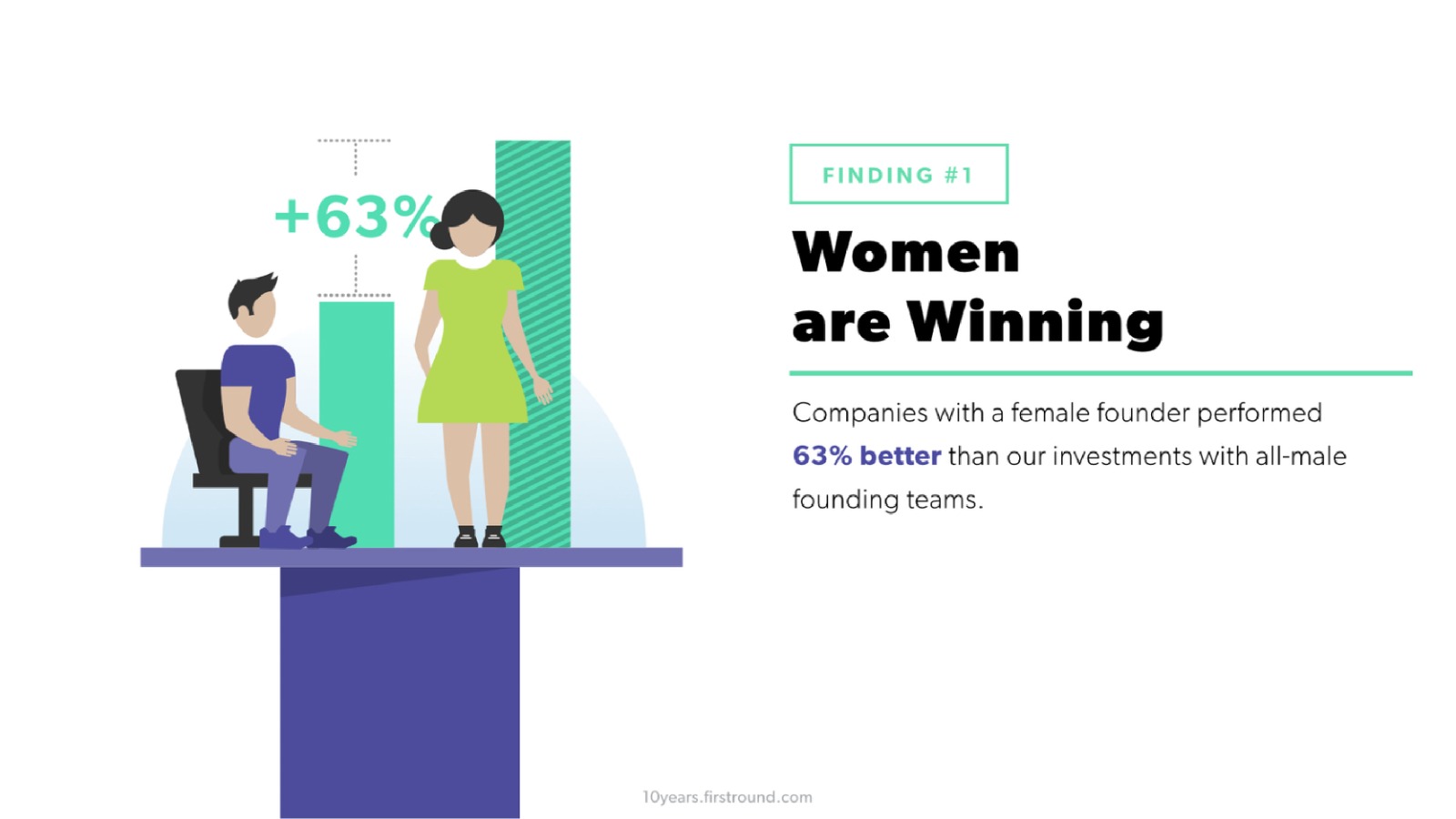

What is ironic is that women-led firms perform strongly, and often prove better financial investments than those led by men - In terms of how effectively they turn a dollar of investment into a dollar of revenue. A BCG report found that for every dollar of funding, female-founded startups generated 78 cents, while male-founded startups generated just 31 cents. Women founders also outperformed their male counterparts despite raising less money. First Round Capital reported that female-led companies performed 63% better than all-male founding teams and women-led teams generated a 35% higher return on investment than all-male teams.

Why then does this gender gap in funding persist?

1. Biases in Investment: Despite growing awareness, many investors still hold biases, whether unconscious or not, about women’s leadership abilities and commitment to their businesses. A woman CEO of a VC fund based in Mumbai told this story. “When one of our entrepreneurs sent me her wedding invitation, the first thought that came to my head was – will she continue to remain immersed in her business? I realise I would never have thought that if a man had sent me the same invite. I am ashamed to admit even I – as a woman who has always worked - caught myself with such a deep bias’.

…people would raise doubts with questions ranging from ‘How long are you going to do this, this is very operationally intensive?’ to ‘You have a child to take care of’ or ‘Who’s going to be your co-founder?’”

Rashmi Daga, Founder of Fresh Menu

We spoke to 200+ women founders, and they said it was hard for them to raise their first round of seed capital, to hire in product and tech, and it was even harder to meet angel investors or find a co-founder. It was something we definitely wanted to address.” Sakshi Chopra, MD at Sequoia Capital India

2. Lack of Networks: Take an average enterprise in Bangalore and its senior team is comprised of male friends who went to college together from a selection of elite colleges. They leverage their established networks with other ‘old friends’ working at venture capital firms. This access gives them a significant advantage. In contrast, women often lack access to these circles, putting them at a disadvantage during the fundraising process.

3. Perception of Risk: Women entrepreneurs often face scepticism from investors who perceive their ventures as riskier, despite evidence otherwise. A 2018 study published in the Academy of Management Journal found that women are more frequently asked "prevention" questions - focused on potential risks and losses; men are asked questions about growth and profitability. This could impact perceptions of the potential of the business and hinder the ability to secure capital.

Breaking the Barriers

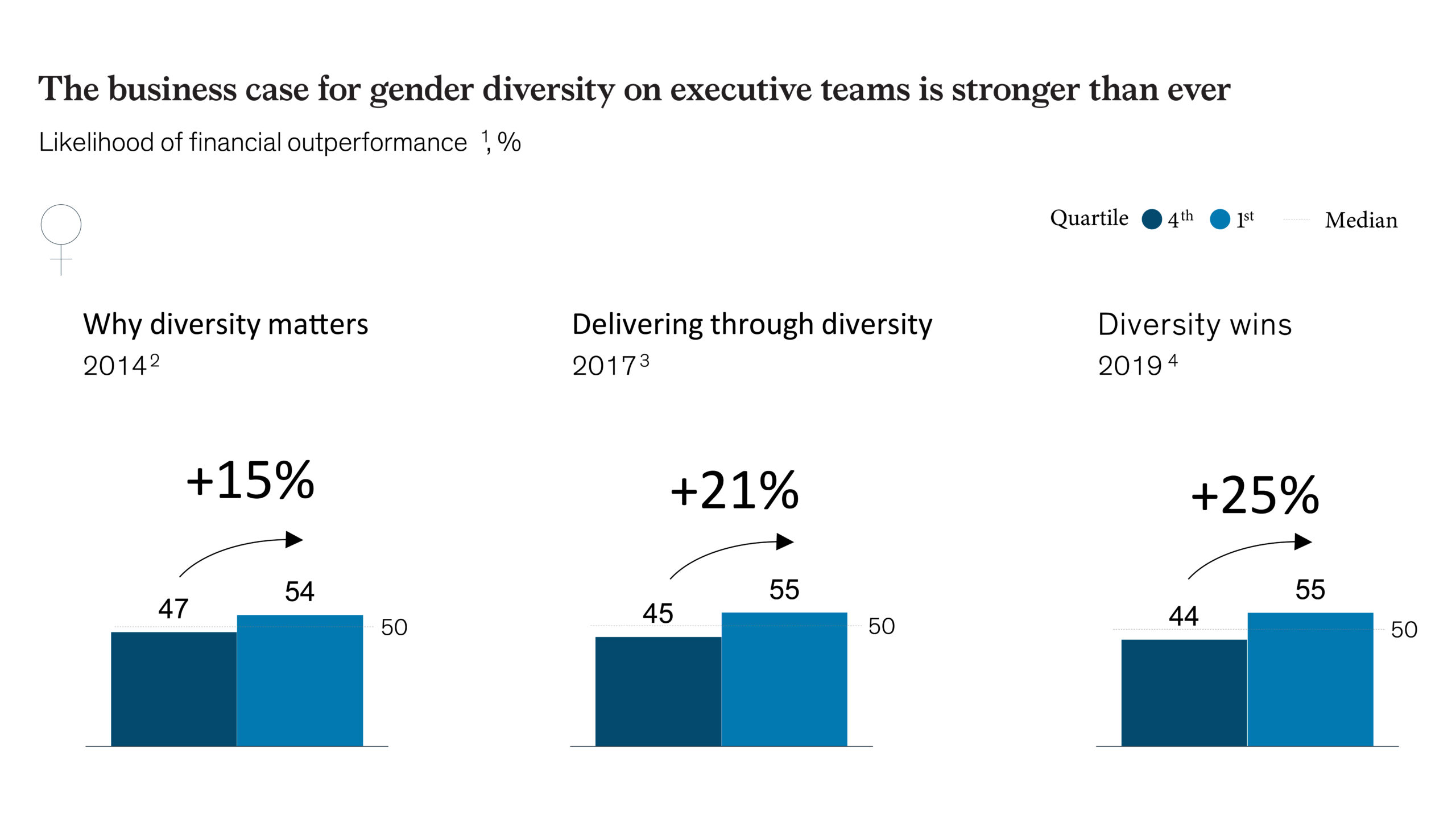

Diversity isn’t just a nice-to-do. A 2020 McKinsey report found companies in the top quartile for gender diversity on executive teams were 25% more likely to experience above-average profitability. What needs to change then to enable more women entrepreneurs to access funding?